- should your property protecting the loan is sold otherwise transmitted.

- Standard

In the event your outstanding dominating equilibrium isnt acquired by the University within ninety 90 days of your own deadline, or within this a specific several months after the acceleration time (always a month), as appropriate, desire could be billed into outstanding prominent equilibrium at annual rates of newest Standard MOP rates or perhaps the restriction rates up coming permitted legally, almost any is reduced, starting out into the due date or perhaps the velocity go out, as the applicable, and continuing through to the full amount of prominent has been paid back. The newest University will get follow all cures available to they to gather the bill owed.

Fund that have nonstandard possess instance balloon money and you will loan terms more than three decades dont be considered as QM finance.

The brand new Chancellor or other appointed authoritative are required to recognize and you will deal with one threat of litigation in the making low-Certified Mortgage loans. At UCSF, this bill and you may acceptance should be closed of the dean regarding the institution (ZIP-06 Consent Setting).

A professional Mortgage (QM financing), because the discussed by the Consumer Finance Cover Bureau, is actually a loan that have particular provides which might be said to generate it probably be getting a debtor to be able to pay back they

The risk of standard develops when the an excellent Zip loan is likely are accelerated. A beneficial Zero mortgage could be accelerated and should be paid out of in a month of your own velocity day if a professors borrower changes from an educational Senate name, minimizes per cent time, retires, transmits to another UC university, or if the brand new secured home is ended up selling or directed (see Payment over).

New Zero loan is considered to be a not as much as sector-price loan. An around industry-speed loan are subject to imputed focus, and that is advertised once the taxable money annually to the a good W-2 form, which is susceptible to standard withholding requirements.

When you find yourself possible to provide good Zip financing so you’re able to an external very first home loan, that would need acceptance by external financial and you can would not impact the down-payment/guarantee requirements of outside very first

One mortgage forgiveness could well be advertised due to the fact nonexempt earnings on the seasons forgiven for the a great W-2 setting which can be susceptible to standard withholding requirements.

Individual taxation criteria are very different together with campus cannot imagine this new taxation weight to own possible Zip users. The latest College or university recommends you to professionals request the tax mentor that have concerns regarding the their unique income tax problem.

Departments will need to provide a signed ZIP Advisory Notice from the candidate with the request for a ZIP loan (ZIP-04).

As with any most online loans Sunshine other UC home loan factors, the Zero-SHLP loan exists via the College or university regarding Ca Construction Guidance Program Firm (the corporation, managed because of the Office from Loan Applications (OLP) at the job of Chairman). Zip resource flows the following:

- University comes with the funding source account information to help you OLP in the Zip Mortgage Accounting Setting.

- Since the loan is preparing to financing, this new university financial support resource account is debited by OLP to cover this new Zip Loan.

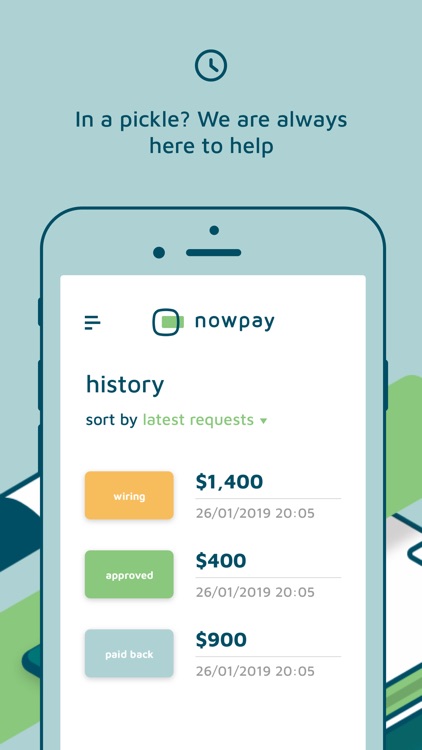

- Zero loan money is wired to escrow to your house get deal.

- The fellow member would are obligated to pay the newest Zip dominant equilibrium for the Enterprise just like the bank.

- If 1/10th of mortgage is forgiven after any year inside term, the main harmony manage go down by you to definitely amount within the season of forgiveness.

- One remaining principal balance for the Due date or even the Velocity Day, since appropriate, is totally owed and you can payable on the Business, that will next remit any such commission into the campus.

Departments will get help property direction having fun with a combination of the newest Professors Recruitment Allotment System (FRAP), the loan Origination System (MOP), the quality Supplemental Financial System (SHLP), and/otherwise a zero Attract Program loan (ZIP-SHLP). An excellent Centrally-Financed Extra Home loan System (CF-SHLP) financing loan.